Our Insurance Agent Job Description Ideas

Wiki Article

The 6-Second Trick For Insurance Asia Awards

Table of ContentsInsurance Agent for DummiesThe 8-Second Trick For Insurance AdvisorThe Definitive Guide for Insurance AdvisorThe Best Strategy To Use For Insurance And InvestmentThe Facts About Insurance Commission Uncovered

Various other sorts of life insurance policyTeam life insurance policy is normally supplied by employers as part of the business's office advantages. Premiums are based on the group in its entirety, as opposed to each person. As a whole, employers provide basic insurance coverage free of cost, with the option to buy extra life insurance policy if you need much more coverage.Mortgage life insurance coverage covers the present equilibrium of your home loan and pays out to the lending institution, not your family members, if you pass away. Second-to-die: Pays after both policyholders die. These policies can be made use of to cover estate taxes or the care of a dependent after both policyholders die. Often asked questions, What's the most effective sort of life insurance policy to get? The very best life insurance plan for you boils down to your demands and also spending plan. Which sorts of life insurance policy offer versatile premiums? With term life

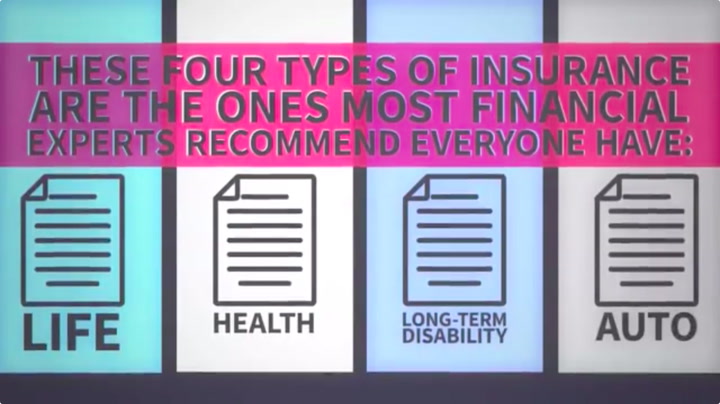

insurance and also entire life insurance policy, costs normally are repaired, which implies you'll pay the same amount every month. The insurance policy you require at every age varies. Tim Macpherson/Getty Images You require to get insurance to protect on your own, your family members, as well as your wide range. Insurance policy might save you thousands of dollars in the event of an accident, ailment, or catastrophe. Medical insurance and auto insurance policy are needed, while life insurance policy, homeowners, occupants, as well as disability insurance policy are encouraged. Start totally free Insurance coverage isn't the most thrilling to consider, however it's necessaryfor shielding yourself, your family members, and also your wide range. Mishaps, ailment, as well as calamities happen regularly. At worst, events like these can dive you right into deep economic mess up if you do not have insurance to drop back on. And also, as your life modifications(claim, you get a new task or have a baby)so must your insurance coverage.

Not known Details About Insurance Meaning

Listed below, we've described briefly which insurance policy coverage you must highly consider getting at every phase of life. As soon as you exit the working globe around age 65, which is often the end of the longest policy you can get. The longer you wait to get a plan, the better the eventual cost.If a person else depends on your revenue for their monetary health, then you possibly need life insurance policy. The finest life insurance coverage policy for you depends on your budget plan as well as your financial goals. Insurance coverage you require in your 30s , Homeowners insurance coverage, Homeowners insurance coverage is not called for this link by state legislation.

Some Known Details About Insurance Quotes

-If, nonetheless, you survive the term, no cash will be paid to you or your family. -Your household obtains a specific amount of money after your fatality.-They will certainly also be qualified to a benefit that frequently accumulates on such quantity. Endowment Policy -Like a term policy, it is additionally valid for a certain duration.- A insurance estimator lump-sum quantity will be paid to your household in case of your fatality. Money-back Plan- A certain portion of the amount assured will be paid to you regularly throughout the term as survival advantage.-After the expiration of the term, you get the balance amount as maturity profits. -Your family members gets the entire sum ensured in situation of death during the policy period. The amount you pay as costs can be subtracted from your complete gross income. This is subject to an optimum of Rs 1. 5 lakh, under Area 80C of the Revenue Tax Obligation Act. The costs quantity made use of for tax obligation reduction need to not exceed 10 %of the sum assured.What is General Insurance policy? A general insurance policy is a contract that offers economic payment on any kind of loss other than fatality.

Some Of Insurance Commission

The insurance provider worked out the expense directly at the garage. Your health insurance dealt with your treatment prices. Your financial savings, hence, stayed untouched by your unexpected disease. As you can see, General Insurance coverage can be the answer to life's various troubles. visit the website Yet, for that, you require to choose the best insurances from the myriad ones available. What are the kinds of General Insurance coverage readily available?/ What all can be guaranteed? You can get practically anything and every little thing insured. Pre-existing illness cover: Your medical insurance looks after the treatment of diseases you might have before acquiring the wellness insurance plan. Crash cover: Your health and wellness insurance can spend for the medical therapy of injuries triggered because of crashes as well as mishaps. Your wellness insurance coverage can additionally assist you conserve tax.Two-wheeler Insurance, This is your bike's guardian angel. As with car insurance policy, what the insurance provider will pay depends on the type of insurance and also what it covers. Third Event Insurance Policy Comprehensive Auto Insurance Policy, Makes up for the damages caused to another an additional, their vehicle automobile a third-party propertyResidential property

Report this wiki page